10 Ways You Can Easily Save Yourself $10 and More

Are you ready to set some financial goals for your family? If you find yourself living paycheck to paycheck, it can seem impossible to put any money in savings. The most important thing you can do is to just get started. Even a small amount can help. Here are 10 Easy Ways To Save $10 or More

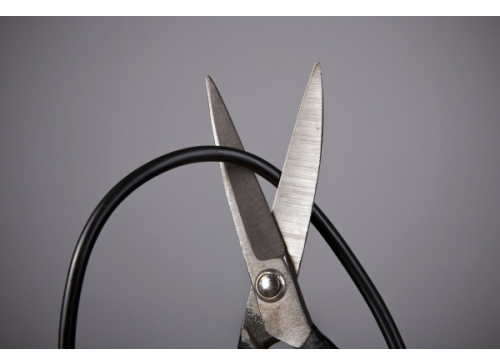

Cut the cable cord

A cable tv subscription service can cost upwards of $100 per month, and even more if you have specialty channels. Think about discontinuing your cable and signing up for cheaper streaming services instead. The most popular streaming services, Hulu, Disney+ and Netflix, are less than $13 per month. If you have Amazon Prime, lots of content is included for free — and you can often snag deals on premium subscription channels. Did you know that Walmart+ members can score free Paramount+? If you don’t have a smart tv, you can still use streaming services with an Amazon Fire Stick, Fire Cube, or Roku.

Sign up to get rebates on your groceries

Fetch Rewards is an app that pays you in gift cards just for uploading pictures of your paper receipts. Check out our review of this simple service HERE.

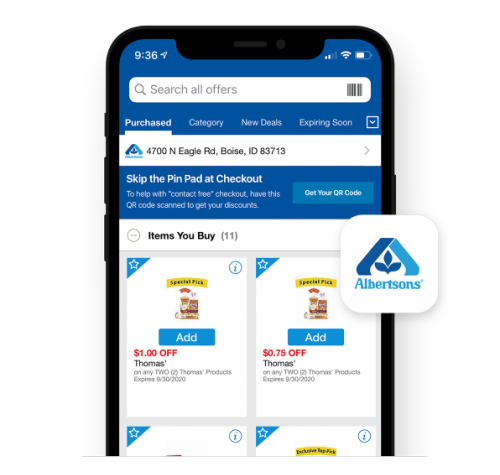

Use Grocery Store Rewards Programs

Grocery stores, such as Albertsons and Fred Meyer offer Member Only Savings by using their app. Some stores also give rewards to shoppers that can be used for other purchases, such as groceries or fuel. These programs are free to sign up for, and usually easy to use.

Plan Your Meals

There are several benefits to planning your meals in advance. We love to use Prepear to make planning your meals for a week and doing your shopping all at once. This can help you to save on ingredients, you will have less waste, and won’t have to turn to takeout as often. Check out our 15 Meal Planning Tips To Save Money and Time.

Shop Around For Auto Insurance

It’s no secret that auto insurance can be VERY expensive. What most people don’t realize is that rates can vary greatly from one insurance company to another. Everyone has seen the Geico Gecko telling us to shop around for car insurance. It turns out that he knows what he is talking about!

Invest your small change

Invest your small change

Consider an app like Acorns, which rounds up all of your online purchases to the nearest dollar. Once your balance gets up to $5, Acorns will invest your money into a low-cost portfolio of your choosing. You can also choose to do something like the $5 Savings Challenge.

Watch your energy spending

Check to see if your electric or gas provider offers an “energy audit”. They may be able to give you suggestions about what you can do to save on energy costs.

Take up “Thrifting”

Check 2nd hand stores for clothing, furniture, and household items. This can save you money, and reduce consumer waste. Check out ways to make thrift store buys even better.

Never use ATMs that charge a fee

Many banks will charge you to use their ATM if you don’t have an account with them. Plan ahead and get cash back when making purchases so you will have the cash you need, without the extra cost.

Take your lunch to work

Eating out can get really expensive. Try packing your lunch the night before so you won’t be tempted to grab take out if you you are running late the next day. It is fab to put dinner leftovers right into a fun, reusable lunch box. ready to grab and go on a busy morning. Stock up on lunch favorites.

Following these easy, money-saving tips can help you to tighten your budget and save for a rainy day.

- Download our FREE app [CLICK HERE!]

- Tap to select the types of deals and brands you want deals on.

- Sit back and relax… we’ll find the deals and send you a notification when the stuff you want costs LESS!

Report a Problem

Please select the problem you are facing with this deal:

- Price Increased

- Price Decreased

- No longer available

- Expired

- Link doesn't work

- Suggestion

- Compliment

- Other

Add more details:

Thank you for your feedback. We really appreciate it.

Enter your email address if you would like to receive a follow up.

Please Try Again