How to Make a Simple Budget Easily in 5 Steps!

Trying to manage your finances without a budget is like trying to find directions in a new city without a map, GPS, or smartphone! AKA: BASICALLY IMPOSSIBLE!

Learning how to make a monthly budget is a necessary step in taking full control of your finances. It’s a quick and easy snapshot of where you stand financially.

A budget will help you to successfully stay on track, pay off debt, protect your credit, effectively save, and achieve your financial goals. Since this is so important, I’m going to show you how to make a simple budget and how to stick to it!

Five Steps to Create a Simple Budget

1. Start with the basics

The first step is to find a method to record your budget. Explore what works best for you. For some, writing it all down on a piece of paper works great, while others may choose to use excel or a budgeting app.

Whatever you decide on, make sure it’s something you will keep up with and access often (here is an excel budget template).

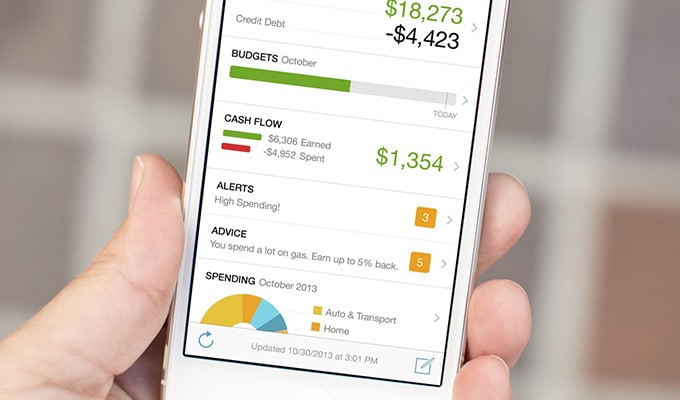

Here are some of the top budgeting apps:

- You Need a Budget

- Mint Budgeting App

- PocketGuard Budgeting App

- GoodBudget

- Spendee

- Unsplurge

- EveryDollar

And many more! Look through these apps up and see if one of them works for you. Having your budget on your phone will make it A LOT easier to not forget about it!

2. Budgeted amount & actual amount

Next, create two categories for your budget:

- Your budgeted amount; and

- Your actual amount spent (if you are using a budget app, make sure that this is available).

These categories will allow you to input your planned income, keep track of differences, and adjust for any fluctuations or irregular expenses. It is so important to keep these things recorded!

For example, during the winter a lot of time our heating bill goes up! If I record how much it went up one year, I can look back at my budget from the last year and make a good guess as to how much I should budget for heat!

3. Calculate your monthly income

Your monthly income should be the first number you see on your budget since this is the number that really determines what is available to spend. Take a look at a few of your most recent pay stubs in order to get an idea of your net pay (pay after subtracting taxes and other deductions).

The most common pay schedules are monthly, bi-monthly or bi-weekly. Now, time to utilize some exciting math to figure out your monthly net pay!

- If you are paid bi-monthly (twice a month) times your monthly salary by two.

- Example: $1000 x 2=$2,000 net monthly salary

- If you are paid bi-weeky (every two weeks), times your income by 26 and divide by 12.

- Example: $1,000 bi-weekly x 26/12=$2,166.67 net monthly salary.

- If your income fluctuates makes sure you adjust accordingly.

Having this number is CRUCIAL! Once you know how much money you make a month, you can build your budget from there. The key to a budget is to NOT overspend and if you don’t know your limit, you are setting yourself up for failure my friend (and let’s be honest, you will probably overspend!!)

4. List your monthly expenses

Monthly expenses should include anything and everything you are going to use money towards during the month. This includes:

- Housing

- Loan payments

- Credit cards

- Gas

- Insurance

- Household bills

- Groceries

- Gifts

- Clothing

- Savings; and

- Entertainment

Don’t forget to add any quarterly or annual expenses (such as HOA fees or taxes) in order to plan accordingly.

Side Note: The first few times doing a budget will be very time-consuming. You will need to gather together all the information and the amount for each bill BUT, after you do all the dirty work, IT IS SO EASY to maintain a budget.

So, keep your receipts, look at your bank account for past transactions, and keep a copy of each bill you pay during the month. Once you have all of that, you are ready to build your expenses list!

5. Subtract your expenses from your income

Take your monthly income and subtract all of your monthly expenses. Be sure to leave room for adjustments or fluctuations as many household bills are not always fixed.

I like to always ROUNDUP! It is better to have extra money than to not have enough! Anything leftover can be put towards savings, retirement, or whatever else you may choose.

You now know how to create a simple budget

Creating a budget really is as simple as that. Remember though, sticking to your plan is just as important as coming up with it. In order to stay on track and navigate your way through your finances, be sure to keep up with your budget. Make changes as necessary!

It will take you a bit to get everything down to a T so don’t give up! You may be surprised at how much quicker your financial goals can be accomplished by having a simple budget in place.

4 Tips to Help You Stick to Your New Budget

1. AVOID your spending triggers

Don’t just go into your favorite store and plan on not spending any money because most likely you will! Do not stay up late on the computer browsing clothes websites because you will probably overspend buying your children clothes they don’t need! Just stay away from your weak spots!

2. Talk about money openly in your marriage

Don’t be guilty of finding ways to get around your husband knowing what you spend! If you can’t talk about a purchase openly and without justifying it, that’s a sign that you probably shouldn’t buy it!

3. Have you monthly budget done BEFORE the month starts

Go into the month knowing exactly what you are allowed to spend! Having a plan will make your chances of success go WAY up!

4. Use cash instead of credit

For some, it’s a lot easier to spend money when you are just swiping a card. When you actually have to count out the cash, you’re more aware of exactly what you are spending and what you have left!

To help keep yourself in check, use cash as often as you can! Check out an oldie but a goodie… a blog post about the cash envelope system!

You can do it!

I believe in you! You can make a budget and stick to it! Now is the perfect time to write things out, use our Excel Budget Template, or download the app and start your budget today! It will make your life a lot less stressful, TRUST ME! Happy Budgeting!

Trending Posts

Comments

Leave a Reply

Report a Problem

Please select the problem you are facing with this deal:

- Price Increased

- Price Decreased

- No longer available

- Expired

- Link doesn't work

- Suggestion

- Compliment

- Other

Add more details:

Thank you for your feedback. We really appreciate it.

Enter your email address if you would like to receive a follow up.

Please Try Again

I am sad that you did not include YNAB (You Need A Budget) budgeting software and app. It has worked for thousands of people, including myself. It is one of the best budgeting software and apps around!!!

Everydollar.com is the Dave Ramsey app.