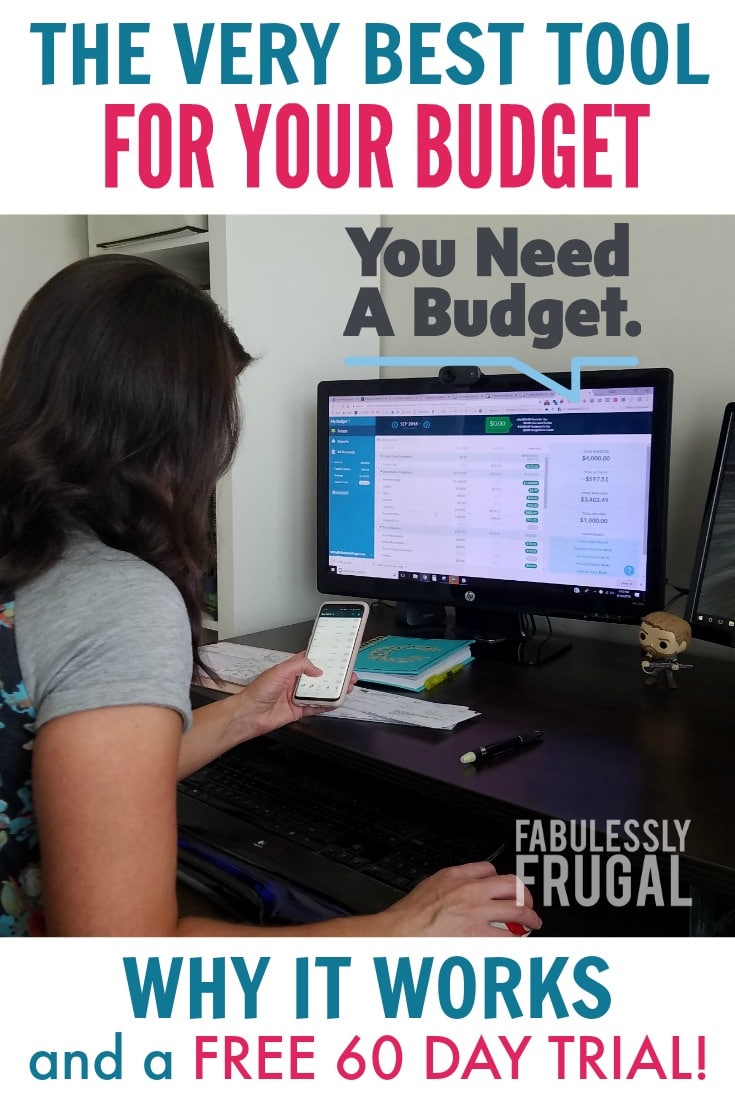

You Need a Budget Review + FREE YNAB Trial!

Are you tired of living paycheck to paycheck? Are you READY to finally get out of debt? OR maybe you are committed to really start saving more money? If you answered YES! – I’m excited to share my You Need a Budget review with you to show you how it can help you accomplish all of the goals above (and more)! I’ve been using it since 2010 and LOVE IT!

Now before we get started, yes, I realize there are hundreds of different kinds of budgeting apps and spreadsheets available for cheap or free, but you’ll be hard pressed to find a budgeting app that does more than just create a budget. Years ago I used Quicken, but found that all it did was track my money… budgeting with Quicken was NOT effective. I’ve also tried Mint but didn’t like the budgeting feature and their interface is clunky in my opinion.

However, when I discovered YNAB, I immediately fell in love. To me, it’s like the cash envelope system… in digital form! Today in my YNAB review I’ll share WHY it works, HOW it works, and I’ll highlight some of my favorite features!

PS: I have a special link that will get you a FREE 34 day trial for YNAB.

YNAB Review: How it Works

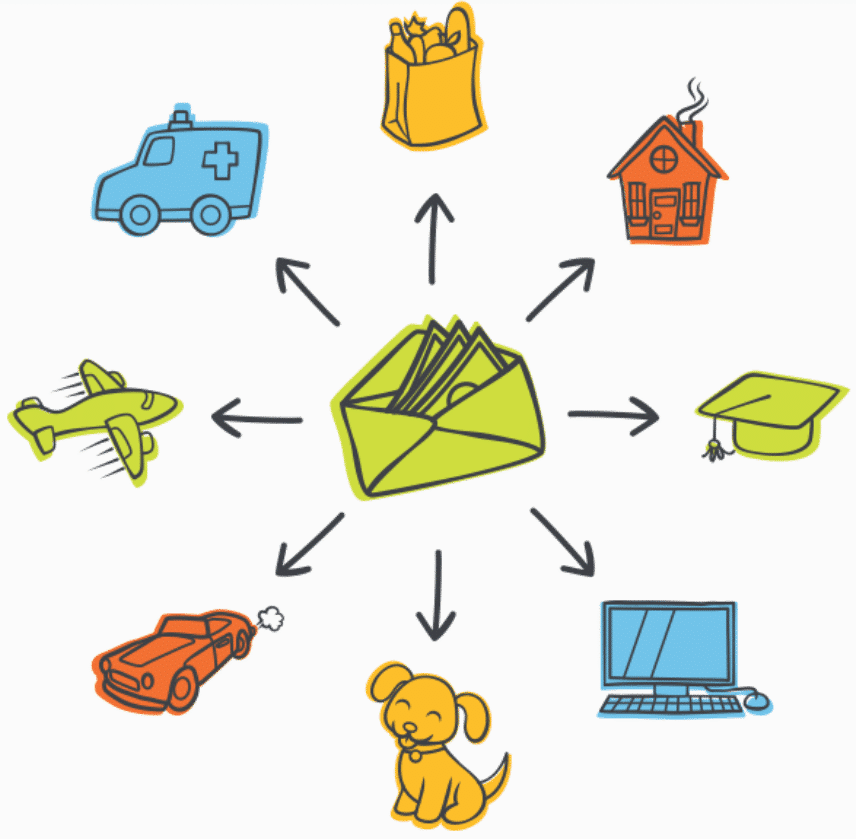

YNAB is based on the premise of zero-based budgeting… just like Dave Ramsey says, “If you don’t tell your money where to go, it will leave.” So in YNAB, you give EVERY DOLLAR a job! When each dollar has a place to go, you won’t spend more than what you have.

Setting up the budget is easy too… simply enter in your income for the month, create your budget based on what you want to spend or save, and then let YNAB help you with the rest!

The Four Rules of Budgeting with YNAB

YNAB is built on the premise of four rules and using it will help you follow these rules and break poor spending habits. Here is a brief overview of the four rules (they have a free workshop you can attend online to go into more depth and learn how to do this within YNAB).

Rule 1: Give every dollar a job

Rule 1 focuses on the concept of only budgeting the money you have. In order to be intentional with your money, and where you want it to go, you have to determine what you want to do with the money you get. In YNAB, you’ll be able to see how much money you have to budget and assign them to a specific category. The goal is to budget down to $0.

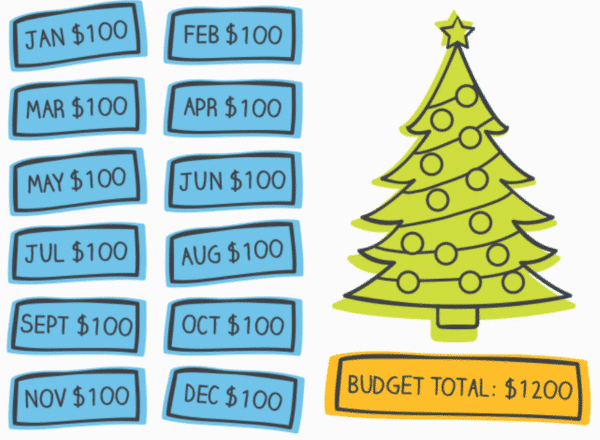

Rule 2: Embrace your true expenses

Rule 2: Embrace your true expenses

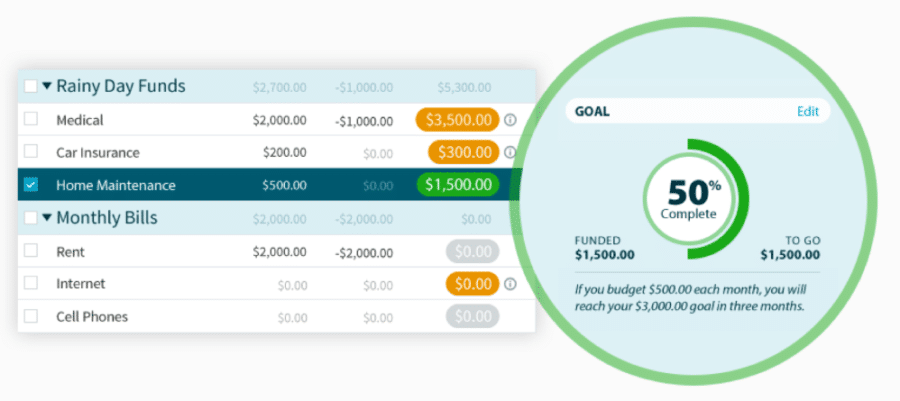

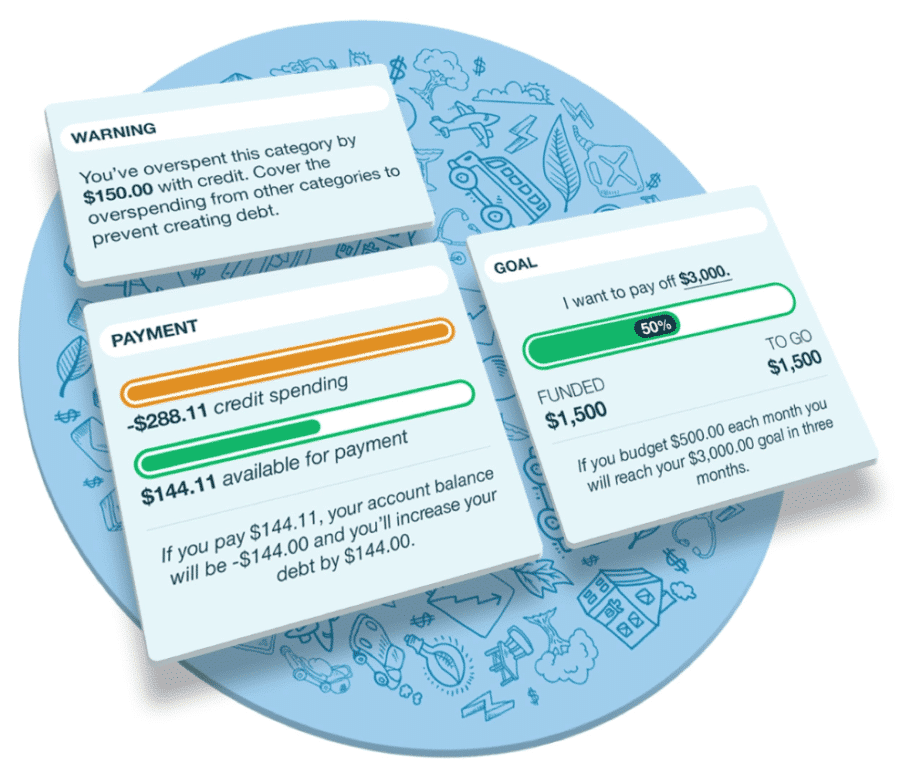

While you want to focus on the expenses that require your immediate attention such as bills, gas, and groceries, Rule 2 helps you focus on saving for those non-monthly bills… like Christmas, vacation, annual insurance premium, and so on. This is where YNAB comes in. You can create goals (more on that below) and YNAB will tell you how much you need to budget each month in order to reach your goal.

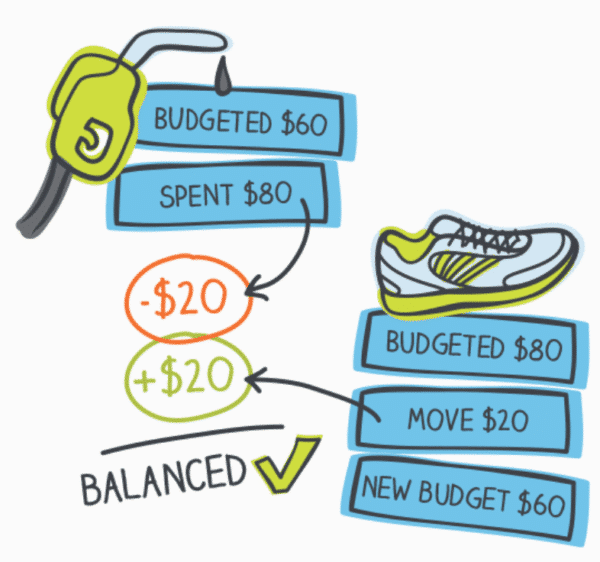

Rule 3: Roll with the punches

Rule 3: Roll with the punches

This might sound like an odd rule, but what it means is that you may need to change your budget down the road. If this ever occurs, just change it! Don’t hold on to guilt or feel bad about the fact that you overspent in a category, but adjust to make your budget work. Using YNAB you can easily move money to where you need it by making your budget more flexible. (More on that below)

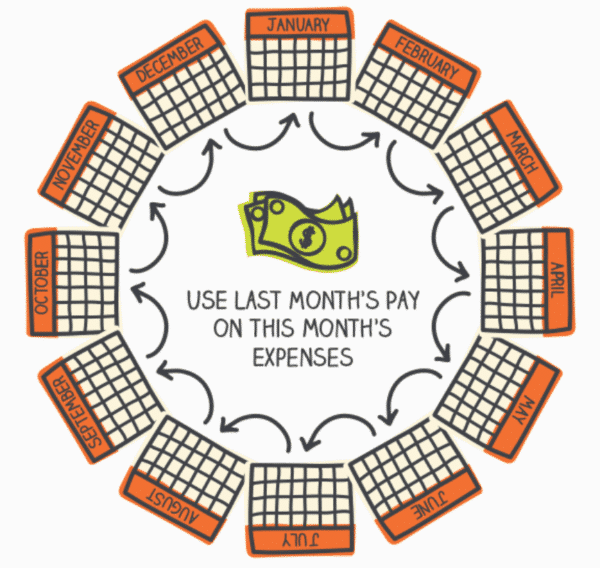

Rule 4: Age your money

Rule 4: Age your money

What this means is that eventually, you’ll get to the point where your money is “30 days old”. That means that everything you earn THIS MONTH will be used to pay your expenses the following month! Sounds awesome, doesn’t it? YNAB will not only help you work toward being a month ahead of your expenses, but it will also help you with your savings goals.

6 of My Favorite YNAB Features

For this YNAB review, I want to tell you about my favorite features that YNAB offers. Keep in mind there are a lot of other features they offer as well, these are just the ones I use the most!

1. Direct Import

Direct import will help you make sure that you can track all of your transactions using YNAB. These transactions import once they clear in your bank, however, you should still record your spending in the app.

When your transactions are imported, they match up right in the app so you can make sure you don’t miss a thing and you aren’t recording duplicates. You can link right to your bank and it will automatically import OR you can download a QFX file from your bank and drag it right into YNAB and import.

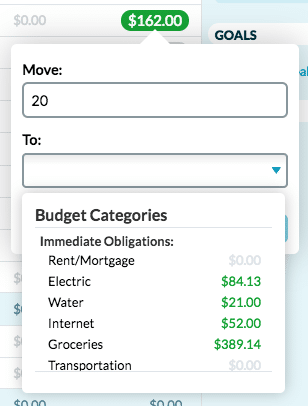

2. The Move Money Feature

Budgets are not made to stay the same forever, and if they don’t change they won’t work. If you need to use Rule 3 and change a category in your budget, using the moving money feature can help you move money from one category to another so it’s easier to track. It only takes four easy steps:

- First, choose the category you want to move money from

- Once you’ve determined the category, click on the available number

- Enter the amount of money you want to move

- Choose the category you want to move the money to

As you can see YNAB can be used for so much more than just simple budgeting. This tool will not only help you stay on budget but will also keep you accountable for your goals and spending habits.

3. The YNAB Mobile App

This is one of my favorite parts of YNAB. You can check your budget real-time, which makes staying on a budget easier because you and your spouse can easily stay on the same page!

- Not sure if you’ve got money left in your budget to buy pizza for the kids? Log into your app and quickly view what is left in your eating out budget!

- At the grocery store? Right after you check out, you can enter your purchase into the app and it will immediately reduce what is available in your budget.

Think of it as the virtual envelope system. Also, if you import transactions, YNAB is smart and will match them up automatically, so you don’t have duplicates!

4. Goals Goals Goals

Planning a vacation next year? Want to pay cash for a bathroom remodel? Or maybe you want to save up for a car? Set a goal for that category and YNAB will automatically calculate how much you need to set aside in that category each month to reach the goal!

5. Pay Down Debt

With all the education and tools YNAB offers, getting out of debt and staying out of debt actually feels possible! You can also use the goal feature I mentioned above to pay off debt!

I know a lot of people like to use credit cards to earn miles, cash back, and other rewards. With YNAB, when you purchase something on the credit card, it automatically moves that cash to your credit card category so when it comes time to pay the credit card in full, you still have the cash to do it!

6. Awesome YNAB Support:

YNAB isn’t just out to sell you a product that you’ll never use. They are all about the education baby! You’ll see under the support tab, you can decide how much time you want to spend learning about the app. They have education in the form of free live classes, help docs, forums, podcasts, newsletters, videos, and a thorough FAQ section. I’ve never seen so much handy and helpful information on money management!

Also within the app (either computer or mobile device) you can quickly access support when you run into a question.

How to Get a 2 Month Free YNAB Trial

Now that you’ve read my in-depth You Need a Budget review, are you ready to give it a whirl?? Just go HERE and you can sign up for a free 34-day trial! YOU DO NOT HAVE TO ENTER IN PAYMENT INFO in order to sign up for this trial!

If your spending is out of control, or even if you’d just like a better picture of your money and want to be more intentional about how you are using it, I highly encourage you to Give YNAB a try! Go HERE and you’ll get two months free to test it out for yourself!

Do You Already Have YNAB? What is your favorite feature?

PS – for my techy people, there is a YNAB Chrome extension you can install and you’ll be able to customize YNAB even more! I use it on my chrome browser so I have a running balance on my check register. The extension also offers a “reports” screen and several other “cosmetic” settings you can change.

Trending Posts

Comments

Leave a Reply

Report a Problem

Please select the problem you are facing with this deal:

- Price Increased

- Price Decreased

- No longer available

- Expired

- Link doesn't work

- Suggestion

- Compliment

- Other

Add more details:

Thank you for your feedback. We really appreciate it.

Enter your email address if you would like to receive a follow up.

Please Try Again

Rule 2: Embrace your true expenses

Rule 2: Embrace your true expenses Rule 3: Roll with the punches

Rule 3: Roll with the punches Rule 4: Age your money

Rule 4: Age your money

Could you suggest a free system that is maybe a step down from ynab?

Hi Charity! I’d suggest Mint if you’re looking for free. It doesn’t have all the options that YNAB does, but does allow you to view all your accounts in one place.

So how much does it cost?

How say is it to use if I’m not real savvy with a computer?

Hi Randi! They have a TON of info to help you learn how to use it. There are live webinars, or video tutorials you can watch, or articles you can read. A LOT of great support! Plus you have 2 months to figure it out with my free trial offer, so you should know well before it’s time to pay if this is going to be a good fit for you or not. Great question! Come back and let me know how you like it!

I absolutely love YNAB. It’s the one app I have stuck with. I really like the goals, tool and budget features. I put aside money every month for the subscription fee. Thanks to YNAB we paid off over $88k and love watching the money we earn grow & grow!

That is so awesome Kendra… way to go!!

The trial said 34 days when

Can I still get a 90 day free trial? Or has it expired?

Hi Peggy, the trial is for 34-days. I corrected the spot it said 90, thanks for letting us know!